Introduction

A key strategy in tax planning is to legally transfer your taxable income, which may be in a high tax bracket, to others around you who may be in a lower tax bracket. Putting your child on the payroll is a great way to do this, but it has to be done correctly for it to work.

The Two Main Tests

The two main tests to consider when employing your child are:

- Reasonable Pay

- Reasonable Work

Explaining the Benefits

Let me explain the benefits of employing your child first.

The standard deduction for a single taxpayer begins at $13,850 in 2023 and increases every year for inflation. The greater standard deduction means that a single taxpayer, such as your child, can earn up to $13,850 in W-2 wages and pay not a penny in federal taxes. As the owner of a business, you have the advantage of being able to hire your child to work in your business, creating tax-saving opportunities for both you and your child.

Tax Benefits for Self-Employed Businesses

The big dollar benefits of hiring your child apply to Form 1040, Schedule C taxpayers, and husband-and-wife partnerships because these businesses are exempt from FICA when employing children under the age of 18. The parental proprietorship and partnership hiring rules also exempt wages paid to a child under the age of 21 from unemployment taxes. Keep in mind that a single-member LLC that did not elect corporate tax treatment is taxed as a sole proprietorship for federal tax purposes.

Example 1: Single California Sole Proprietor

- You employ your 9, 11, and 13-year-old children to work in your proprietorship.

- You pay them a fair market wage for the work they perform, which happens to equal $13,850 per child and a total of $38,850 for the year. Children’s federal taxes – Zero! (Note: This is Federal taxes only. The state rules will differ from state to state. The $13,850 standard deduction zeroed each of the children out of federal income taxes for the year.)

- Your tax savings:

- You claim the $38,850 W-2 wages deduction on your Schedule C, reducing both your federal and state income taxes and your self-employment taxes.

- If you are single with Schedule C income and taxable income of $120,000, you save at the 24 percent income tax bracket, the 15.3 percent self-employment tax rate, and the 9.3% for California, for a total of 48.6% bracket.

- The deduction of $38,850 times the 48.6% last dollar tax bracket will reduce your taxes on your personal returns by a whopping $18,881.

- Of course, your tax rate is likely higher or lower than the example above, but you get the idea of how this works to your benefit. Very limited taxes to the child and tax savings to you.

- Yes, you are having your cake and eating it, too.

Tax Benefits for S and C Corporations, Non-Spouse Partnerships, and Self-Employed Taxpayers with Children Age 18 and Over

When you hire a child under age 18, the Form 1040, Schedule C business, and the partnership with only the child’s parents are exempt from Social Security, Medicare, and Federal Unemployment taxes. However, S and C corporations and non-spouse partnerships do not qualify for this benefit. They have to pay the payroll taxes on all employees — period. There is no parental benefit. Similarly, the self-employed individual or the spouse-only partnership with a child age 21 or over does not qualify for any employment tax breaks. This obviously changes the game.

Example 2: S Corporation and Payroll Taxes

Let’s consider the same facts as in example 1, but the three children are employed by the taxpayer’s S corporation and payroll taxes are applied. Here’s how it works:

- $2,972 employer FICA and Medicare taxes on the $38,850 in wages paid to the three children

- $2,972 employee FICA and Medicare taxes extracted from the three children’s $38,850 in wages

- $1,200 in state and federal unemployment taxes (this could be slightly higher or lower depending on the employer’s experience with unemployment and the unemployment condition of the state where the business resides).

- The payroll taxes above have left the pockets of either the children or the business entity, but the bottom line is that the money is now with the government.

- All is not lost, and in most cases, this actually works out pretty well.

- The business gets a tax deduction for its FICA and unemployment taxes.

- Let’s say this is your business and you operate it as an S corporation, so the net income passes to you. The tax deduction for hiring your three children is the $38,850 of wages paid, plus the $2,972 in FICA and Medicare and the $1,200 in unemployment taxes, for a total of $43,022.

- If you are in the 35 percent tax bracket for federal and 9.3 percent for your state (CA), you save 44.3% or $19,059 on your $43,022 deduction.

- Remember, the children pay no income taxes, although they did suffer the $2,972 in FICA and Medicare taxes.

- The tally for the family:

- Cash received from the government: $19,059

- Corporate cash paid out for FICA: $2,972

- Corporate cash paid out for unemployment taxes: $1,200

- Children’s cash paid out for FICA: $2,972

- Net cash benefit to the family: $13,915

- You can see that payroll taxes take a toll, but they by no means kill the strategy. As the owner of this S corporation that hired the children, you just put $13,915 in the pockets of the family. And you are going to do this for a number of years, so this one corporate strategy could be worth a lot of money to you.

- Of course, your savings may differ based on your tax rates. Use the above example with your tax rates to calculate your exact savings.

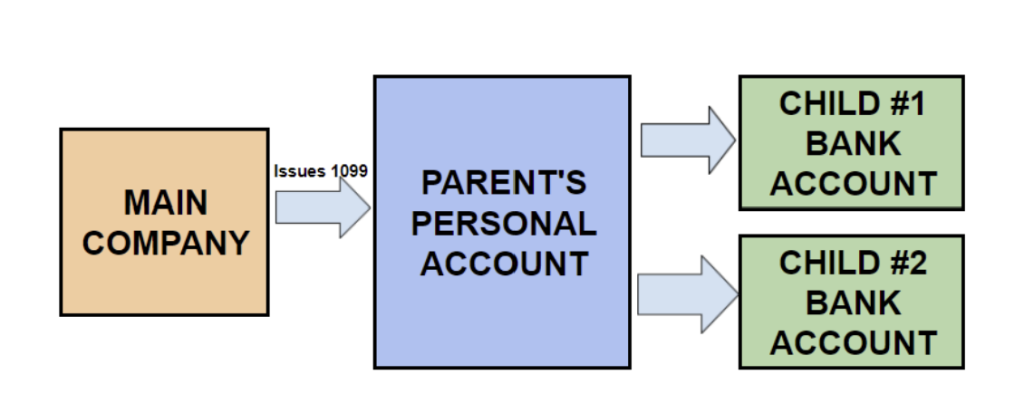

An Alternative Way To Pay Your Children

Consider having the corporation/partnership hire you or your spouse as a labor company, and then you personally hire the children. The reason for this is that when you hire your child and they are under the age of 18, there are no payroll taxes required to be paid (federal, and most, if not all, states follow this rule). The cash flow would go like this:

Reasonable Pay AND Reasonable Work

Under IRS audit, both the pay being reasonable and the work being reasonable will come under question. Examples:

- You can’t have a 5-year-old doing marketing, but you can hire a 5-year-old as a model.

- You can’t pay your 10-year-old much more than minimum wage when hiring for janitorial work or filing.

- You can hire your 16 or 17-year-old as a social media manager. They are probably much better at it than you are.

Filing Requirements

In order to properly deduct wages for your children, you must determine the correct rates and correctly set up payroll for each child you plan to hire. Follow these steps:

- Apply for and set up a sole proprietorship federal tax identification number.

- Set up bank accounts for your children.

- Begin paying this sole proprietor from your company. This is best done on a monthly basis.

- Transfer from the personal/sole proprietor account to your children’s accounts on a monthly basis.

- Payroll tax returns will need to be filed, and W-2s issued for this sole proprietorship.

- A Schedule C will need to be added to your personal tax return.

- A 1099 will need to be issued to the parent who is paying the children.

Best Practices:

- Set this up as automatic transfers done on the same day each month.

- Memorize the transfers in your QuickBooks or other accounting software.

- Have the sole proprietorship owned by the spouse who is not an officer of the business.

Notes:

- If you are already a sole proprietor, you do not need to set up a new one. Just use your existing account.

- It is important that the amount of pay to the children and the work description be reasonable.

- Make sure you have the Schedule C show a small profit.

- Example: If you are paying your child $13,850, you should pay the parent $15,000.

- This will leave a $1,150 profit on the Schedule C.

Additional Possible Savings:

Consider paying the child $18,950 and having the child fund a traditional IRA.

Takeaways

- If you can hire your children, the 2018 tax reform did you a big favor with the greater $13,850 standard deduction.

- The biggest benefits accrue to the Form 1040, Schedule C business or the spouse-only partnership when such a business can hire the under-age-18 child of the parent (or parents, in the case of the partnership).

- Why? Because with such a business, both the business and the parents are exempt from FICA taxes.

- But every business where the owner can employ his or her children likely produces a nice financial benefit for the family.

- Review the tax savings in this article to see how you can come out ahead.