Are We Next? What’s Going on In Florida?

Is what is going on in Florida going to happen here in Massachusetts? That’s the million dollar question, right? Buyers are dreaming for it to happen and seller’s are scared to death about it happening.

First let’s take the idea of a market crash like 2008 off the table.

Now that we have cleared that up, let’s take a look at what’s going on in Florida.

Inventory is up. A lot all across Florida. And these hurricanes and the spikes in insurance rates are not going to help. But let’s just file that under ‘Time will Tell’ and put it in the Common Sense file cabinet.

This WolfStreet.com article had a great quote as to what is going on.“You can sell just about anything if the price is low enough. People are buying homes in Florida, it’s not like no one is buying, but sales have plunged and the price can no longer be whatever.”

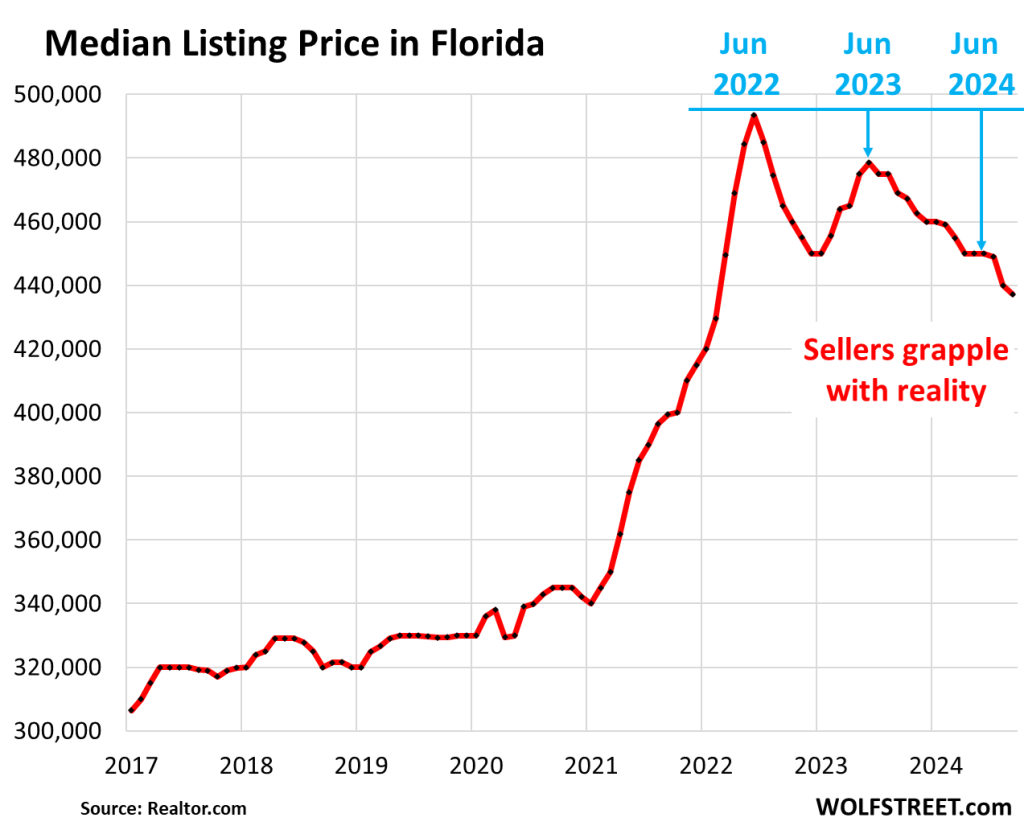

It’s as if some common sense has found the market. And you can see it in the Median Listing Price in Florida since June of 2022. I have my own theory here, but will talk about that a little later.

Active listings have surged 35% year over year in Florida to 185,696 houses on the market. This was the highest for any September since 2016! Demand has decreased and we are now seeing it in the amount of listings and thereby the pricing.

Now here is what is interesting about Florida and something we don’t have here in Massachusetts. Big institutional investors have turned into net sellers! I will say that again, because I was shocked when I read this. Yes, big institutional investors… The Hedge Fund and Private Equity guys have started selling.

It was headline news every other day about the big single-family rental landlords and them buying up single family houses on the open market. At one point they couldn’t buy enough so they switched to building their own build-for-rent subdivisions. And this made sense as these communities are more efficient to operate than individual houses scattered all over the place.

In earnings calls, some of these hedge funds and PE firms started mentioning that they were selling off their more scattered rental properties that they had bought in the foreclosure process. In other words they were selling their lower margin properties that after 10 plus years of ownership most likely need to be rehabilitated in the near future.

Here is the crazy part. In Tampa, Orlando and Jacksonville, institutionally owned single-family houses account for nearly 5% of all the listings on the market according to analysis by Parcl Labs and cited by the Wall Street Journal. Keep in mind that these same institutional funds own between 2 and 4% of the single-family houses in these markets which makes them a net seller!

And to get in front of the underlying question… These guys have some big profits locked in. They can afford to take a little haircut on the sales price, but these guys aren’t going to give these properties away and take huge price losses. In other words these guys are not going to be the trigger of the start of a crash.

Here is where I disagree. The New York Post had a quote that said “I have no doubt that a combination of high prices, high mortgage rates and high insurance has just totally collapsed the market”.

FIrst of all, the market hasn’t collapsed. But I think what we are seeing now is what I will call the “Front Loading” effect. Covid pushed peoples timelines up. Let’s go for a time before Covid. There was a general cycle of people getting older and buying a property in Florida as they retire or shortly before they retire.

I don’t know the stats, but I am sure they could model a certain number of people each year moving down and buying and moving into people’s homes who ah… Let’s say they made their final move. The natural flow of property sales in Florida.

Fast forward to Covid. Stuff went sideways in the world and people moved up their timeline to move to Florida. People a couple of years away from retirement may have pushed up their retirement or decided to finish out their last years taking advantage of the new virtual workforce.

This pushed a lot more buyers into a market with a limited amount of housing and made asset prices jump. But NOW they are paying for it as these people front loading their move thereby cannibalizing the natural progression of sales that would happen in future years.

That is why Florida is going to be different from Massachusetts. This is why I am not worried about what is going on in Florida spreading here.

The article cites a Mr. Holmes who is trying to sell his house for the last 8 months. He bought the house for $550,000 and put an additional $50,000. 8 months of price reductions and his price is down to $583,900. Then add in the Realtor fees on top of it! The guy is going to take a bath.

The market can no longer absorb quick sales. If a Florida home seller needs to sell fast, then they still have the option of going to a We Buy Houses like company and getting a cash offer on their property and closing within 7 days. When looking to sell fast and wanting a cash offer from a company that buys houses, then be sure to look for a reputable company. As an example, Florida Property Solutions is a We Buy Houses New Smyrna Beach company. If you are looking to sell fast, then make sure you find a reputable company that can actually close on your house. There are a lot of want to be straw people out there who won’t be able to perform and just leave a seller holding a bag of issues and walk away without thinking another moment about the person they just hurt.