ICE Mortgage Monitor – June 2024

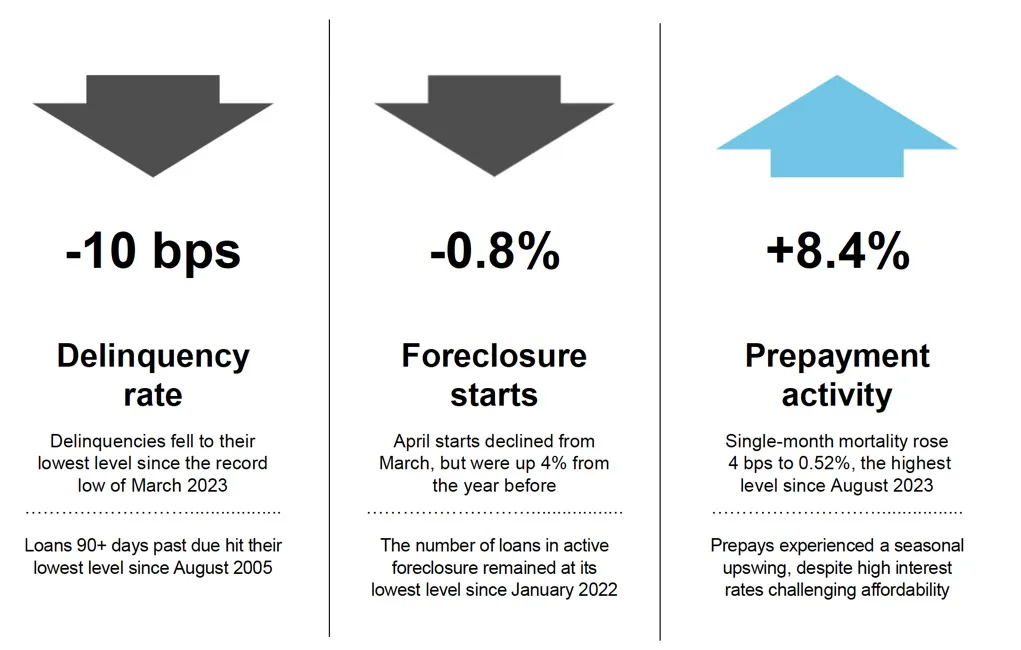

According to the latest ICE Mortgage Monitor (formerly Black Knight), the national delinquency rate eased to 3.09% in April, a 22 basis point improvement over last year. In addition, they report that delinquencies fell to their lowest level since the record low of March 2023. The ICE Mortgage Monitor provides a view of the current […]