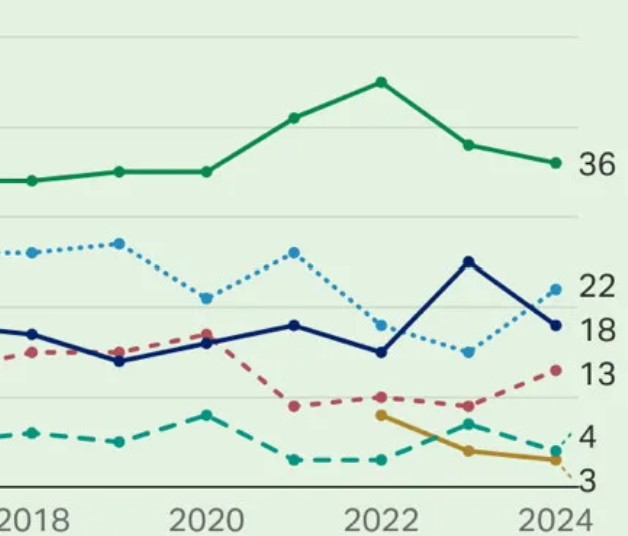

For the 12th consecutive year, Americans continue to favor real estate as their top investment choice.

We have shared this information for several years now, and it remains relevant: According to a recent Gallup report, real estate continues to be the preferred long-term investment choice for Americans for the 12th consecutive year. The breakdown shows that 36% prefer real estate, 22% prefer the stock market, 18% prefer gold, 13% prefer CDs/bank […]